Management Consultancy

Management consultants work with businesses across a wide range of sectors such as finance, HR, and marketing. They are hired by both public and private firms, to improve their practices and efficiency. At SNDJ we do an audit of your current procedures and frame an excellent action plan to boost your growth.

New Business Venture & Start Up Activity

We provide the services for Establishment of New Business Venture & Start up activity in India by Resident of India and for Non-Residents so the client can focus on his business. Our services start from deciding constitution of business, Capital, Project Cost, applicability of various laws and permission for the same. We provide complete services for Registration of Company, Application for PAN, TAN, GST, Import-Export Code, RBI Compliances, Labour laws compliances and many more services applicable for establishment of business.

New Business Venture & Start Up Activity

We provide the services for Establishment of New Business Venture & Start up activity in India by Resident of India and for Non-Residents so the client can focus on his business. Our services start from deciding constitution of business, Capital, Project Cost, applicability of various laws and permission for the same. We provide complete services for Registration of Company, Application for PAN, TAN, GST, Import-Export Code, RBI Compliances, Labour laws compliances and many more services applicable for establishment of business.

Financial Reports Preparation & Analysis

We have dedicated team of experts who provide the services of Financial Reports preparation and Analysis. We prepare

– Preparation of Income Statement, Balance sheet, Cash Flow and Change in Equity Statement.

– Financial Reports as per GAAP, IND-AS or IFRS for the single entities or consolidated for groups.

– Preparation of Consolidated statements from the Subsidiary Company and its divisions.

– Co ordinating with Statutory Auditors

– Business Analysis Reports including various Ratio’s analysis.

– Financial Analysis Reports

By Outsourcing the services to us the company can save time in preparation and analysing the financial reports. Save money by not spending on financial analysis software. Efficient and improved decision making. Accurate and error free analysis of data. Cost effective as well as high quality services.

Financial Reports Preparation & Analysis

We have dedicated team of experts who provide the services of Financial Reports preparation and Analysis. We prepare

– Preparation of Income Statement, Balance sheet, Cash Flow and Change in Equity Statement.

– Financial Reports as per GAAP, IND-AS or IFRS for the single entities or consolidated for groups.

– Preparation of Consolidated statements from the Subsidiary Company and its divisions.

– Co ordinating with Statutory Auditors

– Business Analysis Reports including various Ratio’s analysis.

– Financial Analysis Reports

By Outsourcing the services to us the company can save time in preparation and analysing the financial reports. Save money by not spending on financial analysis software. Efficient and improved decision making. Accurate and error free analysis of data. Cost effective as well as high quality services.

Tax Regulatory, Business Advisory

The Changes in the tax and regulatory environment constantly challenge large and growing business specifically those operating internationally.

At SNDJ We provide tax advisory and regulatory service in India and can help you minimise your tax exposure and highlight the risks presented by constantly evolving and increasing complex legislation. We advise our client about effect of tax on their investment, divestment, M & A, funding, Transfer Pricing, and disclosure required for the same.

Our Expert team provides services in Foreign Direct Investment (FDI), Overseas Direct Investment (ODI), other FEMA aspects, Companies Act, SEBI Regulations, Insolvency Law, Estate Laws. Our team provides overall guidance and assist to the clients in decision making, seeking approvals and overall compliances.

Our Business Advisory services includes business planning, strategy, corporate restructuring, funding solutions, valuations, branding, Due Diligence, Global Expansion and Human Capital Consulting.

Tax Regulatory, Business Advisory

The Changes in the tax and regulatory environment constantly challenge large and growing business specifically those operating internationally.

At SNDJ We provide tax advisory and regulatory service in India and can help you minimise your tax exposure and highlight the risks presented by constantly evolving and increasing complex legislation. We advise our client about effect of tax on their investment, divestment, M & A, funding, Transfer Pricing, and disclosure required for the same.

Our Expert team provides services in Foreign Direct Investment (FDI), Overseas Direct Investment (ODI), other FEMA aspects, Companies Act, SEBI Regulations, Insolvency Law, Estate Laws. Our team provides overall guidance and assist to the clients in decision making, seeking approvals and overall compliances.

Our Business Advisory services includes business planning, strategy, corporate restructuring, funding solutions, valuations, branding, Due Diligence, Global Expansion and Human Capital Consulting.

Business Succession Planning

Business Succession/Exit Planning provides a means to achieving your business and personal goals. It begins with 4 Questions:

– Who will be your successor?

– How much do you need to retire?

– When do you hope to transition?

– What is next for you ?

Succession planning is a delicate transition that requires strategic direction and tactical implementation. Our team of professionals has diverse expertise and consider each viable strategy for attaining greatest value for your business. This unique combination of valuation, merger & acquisition, wealth advisory , estate planning and business and tax strategy experts will help to answer important questions and create successful , well-suited exit plan to complement your lifestyle.

HOW TO PROSPER FROM SUCCESSION PLANNING

ELIMINATE RISKY BUSINESS

RELAX BEFORE YOU RETIRE

Business Succession Planning

Business Succession/Exit Planning provides a means to achieving your business and personal goals. It begins with 4 Questions:

– Who will be your successor?

– How much do you need to retire?

– When do you hope to transition?

– What is next for you ?

Succession planning is a delicate transition that requires strategic direction and tactical implementation. Our team of professionals has diverse expertise and consider each viable strategy for attaining greatest value for your business. This unique combination of valuation, merger & acquisition, wealth advisory , estate planning and business and tax strategy experts will help to answer important questions and create successful , well-suited exit plan to complement your lifestyle.

HOW TO PROSPER FROM SUCCESSION PLANNING

ELIMINATE RISKY BUSINESS

RELAX BEFORE YOU RETIRE

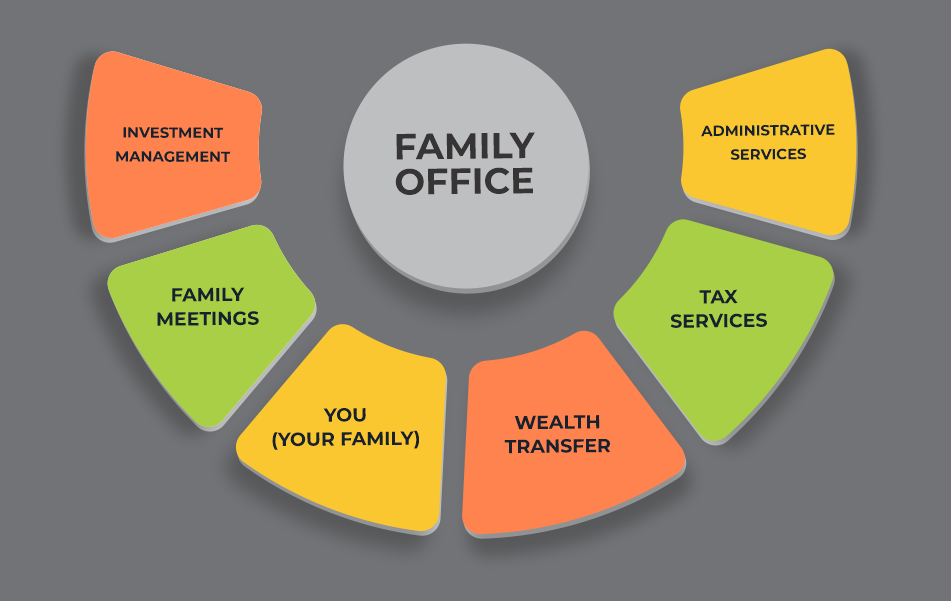

Family Office

The family office landscape has significantly evolved over the last few decades. Wealthy Individuals, multigenerational families, successful business owners and their key advisors turn to us for a personalized suite of services selected to reflect discrete preferences and priorities. We provide private wealth management advisory services to ultra-high net worth investors to centralize focus and control over family finances, legal matters, tax, and administration issues. A family office can be single family office or multi family office. Family office is most commonly utilized because assets have grown in size and complexity, which demand a full-time professional management team to work according to each family’s preferences and goals. Our team of professionals from Accounting, legal, insurance, Investment, Estate, Business and Tax disciplines aim to provide customized planning, advice and resources in order to control several obstacles and maximize our clients legacy. A family may wish to create formal distinction between family wealth and assets of the family business to ensure financial risk diversification and improving transparency and corporate governance of family business.

Family Office

The family office landscape has significantly evolved over the last few decades. Wealthy Individuals, multigenerational families, successful business owners and their key advisors turn to us for a personalized suite of services selected to reflect discrete preferences and priorities. We provide private wealth management advisory services to ultra-high net worth investors to centralize focus and control over family finances, legal matters, tax, and administration issues. A family office can be single family office or multi family office. Family office is most commonly utilized because assets have grown in size and complexity, which demand a full-time professional management team to work according to each family’s preferences and goals. Our team of professionals from Accounting, legal, insurance, Investment, Estate, Business and Tax disciplines aim to provide customized planning, advice and resources in order to control several obstacles and maximize our clients legacy. A family may wish to create formal distinction between family wealth and assets of the family business to ensure financial risk diversification and improving transparency and corporate governance of family business.

Establishment of Business In USA

We at SNDJ provides services for establishment of company in USA. We provide guidance for selection of constitution like LLC, S Corp, C Corp and its advantages and disadvantages. We also help for getting registration process and guidance for bank account opening. Our Experts also provides services in the area of Accounting and Tax related matter of USA Entity. For more details, please click www.sndjglobal.com

Establishment of Business In USA

We at SNDJ provides services for establishment of company in USA. We provide guidance for selection of constitution like LLC, S Corp, C Corp and its advantages and disadvantages. We also help for getting registration process and guidance for bank account opening. Our Experts also provides services in the area of Accounting and Tax related matter of USA Entity. For more details, please click www.sndjglobal.com

Non Resident Indian Tax Strategy Services

We provide services to Non Resident Indians in the area of Indian taxation. We provide services to different profiles of NRI

- Non Resident Indians who have /intend to have Investment in India

- Non Resident Indians who inherit assets in India

- Non Resident Indians / Non Residents who have /intend to set up business in India .

- Emigrating Indian/New NRI

- Returning NRI

How can we help to above profiles ?

- Determination of your residential status in India

- Interpretation of DTAA with a view to reduce tax liability in India

- Guidance for issues relating to Inheritance, will etc.

- Compliance with respect to the Income-tax Act.

- Application for Permanent Account Number ( PAN)

- Filing of Indian Tax Return

- Advising suitable tax savings investments

Non Resident Indian Tax Strategy Services

We provide services to Non Resident Indians in the area of Indian taxation. We provide services to different profiles of NRI

- Non Resident Indians who have /intend to have Investment in India

- Non Resident Indians who inherit assets in India

- Non Resident Indians / Non Residents who have /intend to set up business in India .

- Emigrating Indian/New NRI

- Returning NRI

How can we help to above profiles ?

- Determination of your residential status in India

- Interpretation of DTAA with a view to reduce tax liability in India

- Guidance for issues relating to Inheritance, will etc.

- Compliance with respect to the Income-tax Act.

- Application for Permanent Account Number ( PAN)

- Filing of Indian Tax Return

- Advising suitable tax savings investments